If you’re thinking about selling an inherited house in Florida, the steps you’ll need to take depend on several factors, including how the property was inherited (through probate or a probate-free method), whether the title is clear, and whether all heirs agree to sell.

This guide explains everything you need to understand before moving forward. From probate requirements and necessary documents to tax considerations and your available selling options.

If the process feels overwhelming, you’re not alone. We regularly work with families navigating probate and complex inheritance situations throughout Florida. If you’d prefer a straightforward solution, we can provide a fair cash offer for your inherited home and help simplify the process. Contact us and see how we can help!

What You Need To Know About Selling An Inherited House In

Here are the most important things to know about selling inherited property in :

- Probate is typically required if the property was solely in the deceased person’s name.

- Probate may be avoided through tools such as a Lady Bird Deed, revocable living trust, or joint ownership with rights of survivorship.

- You will need essential documents including the death certificate, proof of ownership and the title report.

- In most cases, all heirs must agree to sell, unless a court orders a partition sale.

- Taxes may apply, including: Capital gains tax, prorated property taxes, documentary stamp tax on deed transfer, depreciation recapture (if the home was previously a rental), and possibly federal estate tax (for high-value estates).

- Selling options include, listing with a real estate agent, FSBO, selling to a cash home buyer or auction.

Understanding these factors early can help you avoid delays and unexpected costs.

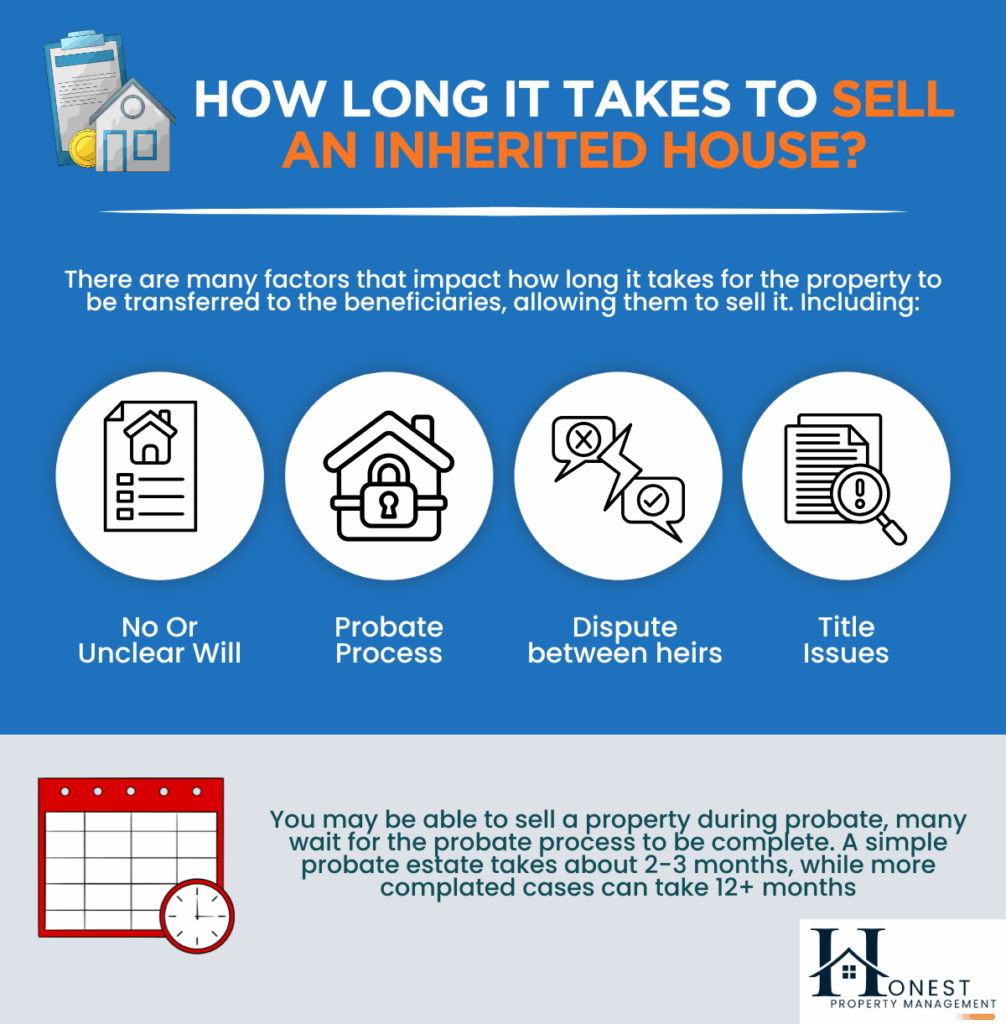

How Long Does It Take to Sell an Inherited House in Florida?

The timeline for selling an inherited house in Florida largely depends on whether the property must go through probate. If probate is required, it typically takes anywhere from 6 to 12 months or longer before the home can legally be sold. In most Florida probate cases, the process takes at least five to six months before the title can be transferred, including the mandatory three-month creditor claim period required by law.

Once the title is officially transferred into your name, you gain full flexibility in choosing how to sell the inherited property. However, in certain situations, it may be possible to sell the home during probate with proper court approval, depending on the circumstances of the estate.

How to Sell an Inherited House in Florida

The process of selling an inherited house in Florida depends on several key factors, including whether the property was a primary residence, the overall value of the home, and whether any estate planning tools (such as a trust or Lady Bird Deed) were used.

Understanding these details will help you determine the correct legal process, whether probate is required, and the best strategy for moving forward with the sale. The steps below will guide you through how to classify your inherited property and choose the right path to sell it efficiently and legally in Florida.

1. Know When Probate Isn’t Required

When selling an inherited house in Florida, it’s important to know that not every property must go through probate. Certain estate planning tools allow ownership to transfer automatically at death, giving heirs the legal authority to sell the home without court involvement.

- Lady Bird Deed (Enhanced Life Estate Deed): The original owner retains full control during their lifetime, and the property automatically transfers to named beneficiaries upon death. Once the death certificate is recorded, the new owners can list and sell the inherited property.

- Revocable Trust: If the home was placed in a living trust, the trustee already has the authority to manage and sell the property immediately, without going through probate.

- Joint Ownership with Rights of Survivorship: When property is jointly owned with survivorship rights, the deceased owner’s share automatically passes to the surviving owner(s). After recording the death certificate, the surviving owner has clear title and can move forward with selling the home.

If probate is not required, you can typically sell the inherited house as soon as ownership records are updated and the title is confirmed free of liens.

However, if the property was left to heirs through a will, or if there is no will at all. Probate is usually required before selling an inherited house in Florida.

2. Determine Which Type of Probate You’ll Proceed With

If the deceased owned the property solely in their name, probate is required before selling an inherited house in Florida. Probate is the legal process that validates the will (if one exists), appoints a personal representative (executor), and ensures all debts and taxes are paid before assets are distributed to heirs.

In Florida, there are two main types of probate:

- Summary Administration: A simplified probate process available when the estate is valued under $75,000 (excluding the primary residence) or when the decedent has been deceased for more than two years. This process can take as little as 4 to 6 weeks.

- Formal Administration: The standard and more detailed probate process, typically lasting 6 to 12 months or longer, especially for larger or more complex estates.

If there is no will, the estate is handled under Florida intestacy laws, and the court supervises the process to ensure creditors are paid before heirs receive their inheritance.

Because probate in Florida can be complicated, many families choose to work with an experienced Florida probate attorney to determine the correct probate type, file the required petitions, and navigate the court process. Honest Property Management also works with trusted probate attorneys to help streamline the process if you decide to sell your inherited home for cash. Need Help? Give us a call at (305) 707-6658, or fill out our form below.

Sell My Miami House Fast For Cash!

3. File for Probate

After determining that probate is required and deciding between summary administration or formal administration, the next step in selling an inherited house in Florida is to file with the probate court. This can be handled by you or a Florida probate attorney.

The process begins by submitting key documents, including a certified copy of the death certificate, the original last will and testament (if one exists), an affidavit of heirs, and the required petitions to open probate. The court reviews these filings to ensure everything is accurate and complete.

- In formal administration, the court issues Letters of Administration, granting the personal representative legal authority to manage the estate.

- In summary administration, the court issues an Order of Summary Administration, allowing assets to be distributed more quickly to the rightful heirs.

Before selling the inherited property, the estate’s debts and creditor claims must typically be resolved. In formal administration, the personal representative is responsible for notifying creditors, reviewing claims, and paying valid debts before assets can be distributed or sold. Summary administration streamlines this process, though creditor rights may still apply.

Once the court’s orders are in place and debts are addressed, the personal representative has the legal authority to move forward with selling the inherited property in Florida. In certain situations, a home may also be sold during probate, which we explain below.

4. Choose How to Sell Your Property

Once you have the legal authority to sell, the next step in selling an inherited house in Florida is deciding how to market the property and close the sale. Your main selling options include:

- List with a Real Estate Agent:

Working with a real estate agent can maximize exposure and potentially secure a higher sale price. However, you’ll typically pay 5% to 6% in commissions, and the closing process may take longer. - Sell to a Cash Home Buyer:

Selling to a cash home buyer is often the fastest and simplest option. Companies like Honest Property Management buy inherited properties as-is, cover most closing costs, and can close in a matter of days or weeks. - For Sale By Owner (FSBO):

With FSBO, you avoid paying a listing commission, but you’re responsible for pricing, marketing, negotiating offers, and handling the paperwork yourself. - Auction:

Auctions provide a quick sale process where the highest bidder wins. However, there is a risk the inherited home may sell for less than its fair market value.

After the sale of the inherited property is finalized, and once the 90-day creditor claim period has passed and all debts and probate fees are paid, the proceeds are distributed to beneficiaries. Until that period expires, funds are typically held in a court-restricted account or the attorney’s trust account before they can be legally disbursed.

When a Home May (or May Not) Be Sold During Probate

When selling an inherited house in Florida, there are situations where a home can be sold during probate. A personal representative a court-appointed individual, bank, or trust company responsible for managing the estate, may be allowed to sell the property if the court determines the sale is in the best interest of the estate and its beneficiaries. Whether a home can be sold during probate depends on several factors, including the type of probate administration, the instructions outlined in the will (if one exists), and whether the sale is necessary to pay estate debts or expenses.

If you’re considering selling your inherited home during probate, it’s important to carefully evaluate the pros and cons and consult with an experienced Florida probate attorney. Even if you or the personal representative secure a buyer, court approval may still be required before the sale can proceed.

When a Home May Be Sold During Probate

There are specific situations in which an inherited house can be sold during probate:

- Non-Homestead Property

- If the home is not considered a homestead property, it may be sold to pay debts or distribute assets among beneficiaries.

- Homestead properties are generally protected from creditors and usually pass directly to heirs.

- Creditors have three months from notice to file claims, which can extend the probate process.

- Will Includes a Power of Sale Clause

- Under Florida Probate Code 733.613, a personal representative can manage estate transactions.

- If the will specifically grants a power of sale, the personal representative can sell the property without court approval.

- Intestate Estates (No Will)

- If there is no will, the court appoints a personal representative to manage the estate.

- The home may be sold during probate, but court approval is required before proceeding.

When a Home May Not Be Sold During Probate

There are certain situations where an inherited house in Florida cannot be sold during probate:

- Homestead Exemption Applies

- Florida law protects a primary residence (homestead property) from most creditors.

- Creditors cannot force the sale of a homestead property, and it typically passes directly to heirs or a surviving spouse instead of being sold to pay estate debts.

- Beneficiaries Object

- If there is no compelling reason to sell, such as paying off debts, and the beneficiaries oppose the sale, the court may deny approval.

- Summary Administration Not Approved

- Until the court grants the Petition for Summary Administration, the property cannot be sold.

- Once approved, the court issues an order distributing assets to the heirs, who can then sell the property.

Each situation is unique, so it’s always best to consult a Florida probate attorney to understand your options for selling an inherited home.

Sell My Miami House Fast For Cash!

Documents Required to Sell an Inherited House in Florida

When selling an inherited house in Florida, having the right documents ready can make the process smoother. While a probate attorney and real estate agent will guide you, here’s a general list of what’s typically required:

- Core Probate Documents

- Certified copy of the death certificate

- Last will and testament (if one exists)

- Affidavit of heirs

- Letters of Administration or Order of Summary Administration

- Property and Title Documents

- Deed to the property

- Title report

- Mortgage payoff statement

- HOA estoppel certificate (if applicable)

- Required Disclosures

- Property condition disclosure

- Lead-based paint disclosure (if built before 1978)

- Radon disclosure

- HOA rules and dues information

- Supporting Records

- Property tax bills

- Receipts for repairs or improvements

- Utility bills

Having these documents ready ensures your inherited property is properly prepared for sale in Florida, whether through a traditional listing, FSBO, or a cash home buyer.

If you are looking to sell your house for cash, give us a call at (305) 707-6658. Or check our our Faq’s page.

Do All Heirs Have to Agree to Sell the Property?

When selling an inherited house in Florida, co-heirs typically need to make joint decisions on important steps like setting the price and accepting offers. If heirs cannot agree, there are alternatives:

- Partition Lawsuit

- A co-owner can ask the court to force a sale or divide the property through a partition lawsuit.

- In this case, the court, not the heirs, manages the process and may appoint someone to handle the sale.

- Buyout Option

- One heir can sell their ownership interest to another heir, allowing the remaining heirs to retain full control of the property.

These options ensure the inherited property can still be sold or resolved even if all heirs don’t initially agree.

Taxes on the Sale of an Inherited Home

When selling an inherited house in Florida, there is no state inheritance tax or estate tax. However, federal taxes may still apply depending on your situation.

It’s important to consult a tax advisor to understand your specific obligations and plan for any potential tax liabilities related to your inherited home.

| TAX | WHEN IT APPLIES | RATE | WHO PAYS |

|---|---|---|---|

| Federal capital gains tax | If the home sells for more than the costs basis | 0%, 15%, or 20% based on income bracket | Heirs on profit from sale |

| Florida documentary stamp tax | Any deed transfer | $0.70 per $100 (0.07%) of sale price; $0.60 in Miami-Dade | Sellers at closing |

| Depreciation recapture tax | If property was a rental or depreciated for business | Up to %25 of depreciation claimed | Heirs at sale |

| Property Taxes | Ongoing until sale closes | Based on county rate | Prorated between seller and buyer at closing |

| Federal estate tax | Only for estates over $12.99M (2025) | Progressive up to 40% | Estate (before heirs receive assets) |

Federal Capital Gains Tax

When selling an inherited house in Florida, the IRS assigns the property a stepped-up basis, which is the fair market value on the date of the previous owner’s death. If you sell the home for more than this value, the difference is considered a taxable capital gain. Selling expenses like commissions, closing costs, and improvements can be deducted to reduce taxable gains.

All inherited property is taxed as a long-term capital gain, even if sold immediately after inheritance. Long-term capital gains are taxed at preferential rates of 0%, 15%, or 20%, depending on your income.

If you live in the inherited home as your primary residence for at least two of the last five years, you may qualify for a primary residence tax exclusion, allowing you to exclude up to $250,000 (single filer) or $500,000 (married couple) from capital gains taxation.

Property Taxes

When selling an inherited house in Florida, property taxes continue to accrue after you inherit the home and must be paid until the sale closes.

- At closing, property taxes are typically prorated between the seller and buyer based on the transfer date.

- Any unpaid property taxes from the previous owner must be resolved before the sale can be completed.

Florida Documentary Stamp Tax (Transfer Tax)

When selling an inherited house in Florida, a documentary stamp tax applies whenever the deed is recorded.

- The standard rate is $0.70 per $100 of the property’s value (0.7%) in most counties.

- In Miami-Dade County, the rate is $0.60 per $100 of the property’s value.

This tax is a required part of the transfer process and must be paid at closing.

Estate Tax

When selling an inherited house in Florida, it’s important to understand that Florida does not have a state estate tax, but federal estate tax may apply for very large estates.

- For 2025, the federal estate tax exemption is $13.99 million.

- If the estate exceeds this amount, the executor must file an estate tax return (IRS Form 706) within nine months of the date of death.

- The estate tax is paid by the estate before assets are distributed, so while it doesn’t directly affect the sale of an inherited property, it can influence the total inheritance received by heirs.

Depreciation Recapture Tax

When selling an inherited house in Florida that was previously used as a rental or for business, you may owe depreciation recapture tax.

- This tax applies to the portion of the gain equal to depreciation deductions previously claimed.

- Depreciation recapture is taxed as ordinary income, with a maximum rate of 25%.

Honest Property Management Make Selling an Inherited House Stress-Free

Selling an inherited house in Florida can feel overwhelming, especially when navigating probate and the sales process. Honest Property Management work with trusted probate attorneys to make the process simple and fast.

Whether you want a cash offer or need guidance on your options, we’re here to help. Contact us today to get started!